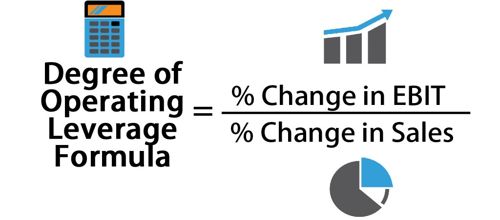

A high DOL indicates that a company has a larger proportion of fixed costs compared to variable costs. This suggests that the company’s earnings before interest and taxes (EBIT) are highly sensitive to changes in sales. When sales increase, a company with high operating leverage can see significant boosts in operating income due to the fixed nature of its costs. Conversely, if sales decline, the company still needs to cover substantial fixed costs, which can significantly hurt profitability. The Degree of Operating Leverage (DOL) measures how a company’s operating income responds to changes in sales.

What are the limitations of using DOL?

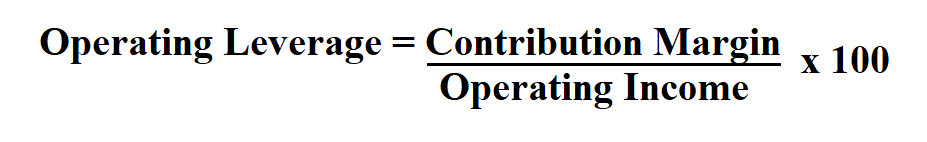

As a result, companies with high DOL and in a cyclical industry are required to hold more cash on hand in anticipation of a potential shortfall in liquidity. However, if revenue declines, the leverage can end up being detrimental to the margins of the company because the company is restricted in its ability to implement potential cost-cutting measures. A second approach to calculating DOL involves dividing the % contribution margin by the % operating margin. Variable costs vary with production levels, such as raw materials and labor. Fixed costs remain constant regardless of production levels, such as rent and insurance.

Assess the Impact of Fixed Costs on Profitability

- The direct cost of manufacturing one unit of that product was $2.50, which we’ll multiply by the number of units sold, as we did for revenue.

- Use the calculator as a strategic tool for enhancing your financial planning efforts.

- Companies with a high degree of operating leverage (DOL) have a greater proportion of fixed costs that remain relatively unchanged under different production volumes.

The management of XYZ Ltd. wants to calculate the current degree of operating leverage of its company. Here, the variable cost per unit is Rs.12, while the total fixed cost is Rs.1,00,000. This ratio summarizes the effects of combining financial and operating leverage, and what effect this combination, or variations of this combination, has on the corporation’s earnings. Not all corporations use both operating and financial leverage, but this formula can be used if they do.

Ask a Financial Professional Any Question

In most cases, you will have the percentage change of sales and EBIT directly. The company usually provides those values on the quarterly and yearly earnings calls. Basically, you can just put the indicated percentage in our vertical analysis common size analysis explained, even while the presenter is still talking, and voilà. However, it resulted in a 25% increase in operating income ($10,000 to $12,500). A high DOL can be good if a company is expecting an increase in sales, as it will lead to a corresponding operating income increase. However, a high DOL can be bad if a company is expecting a decrease in sales, as it will lead to a corresponding decrease in operating income.

Which of these is most important for your financial advisor to have?

Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses.

Great! The Financial Professional Will Get Back To You Soon.

Integrate DOL calculations into your financial planning strategies for better long-term decision-making. Understanding how changes in sales volume affect your operating income allows for more precise forecasting and budgeting. Use the calculator as a strategic tool for enhancing your financial planning efforts. By calculating the DOL, you can identify areas where cost reductions can have the most significant impact on profitability. Use the calculator to pinpoint cost control opportunities and streamline your operations.

The DOL calculator is one of many financial calculators used in bookkeeping and accounting, discover another at the links below. Later on, the vast majority of expenses are going to be maintenance-related (i.e., replacements and minor updates) because the core infrastructure has already been set up. These two costs are conditional on past demand volume patterns (and future expectations). Furthermore, another important distinction lies in how the vast majority of a clothing retailer’s future costs are unrelated to the foundational expenditures the business was founded upon. One notable commonality among high DOL industries is that to get the business started, a large upfront payment (or initial investment) is required.

This is useful for analyzing the risk and potential return of investing in a business. Companies with a low DOL have a higher proportion of variable costs that depend on the number of unit sales for the specific period while having fewer fixed costs each month. Companies with a high degree of operating leverage (DOL) have a greater proportion of fixed costs that remain relatively unchanged under different production volumes. Here, the DOL measures how a percentage change in sales will impact EBIT, reflecting the company’s fixed versus variable costs dynamics.

So, whether you’re a seasoned financial pro or a business owner looking to optimize profitability, keep this guide handy. With the right tools and understanding, you can leverage your fixed costs to drive financial success. The Degree of Operating Leverage (DOL) is a critical financial metric, offering insight into how a company’s operational income is affected by fluctuations in sales.

The degree of operating leverage (DOL) is a multiple that measures how much the operating income of a company will change in response to a change in sales. Companies with a large proportion of fixed costs (or costs that don’t change with production) to variable costs (costs that change with production volume) have higher levels of operating leverage. The DOL ratio assists analysts in determining the impact of any change in sales on company earnings or profit. Operating leverage measures a company’s fixed costs as a percentage of its total costs.

If sales increase beyond this limit, a business may increase its production resulting in a rise in the fixed cost structure. Conversely, Walmart retail stores have low fixed costs and large variable costs, especially for merchandise. Because Walmart sells a huge volume of items and pays upfront for each unit it sells, its cost of goods sold increases as sales increase.